1 OKR examples for Investment Committee

What are Investment Committee OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Investment Committee to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read more about the OKR meaning online.

Best practices for managing your Investment Committee OKRs

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

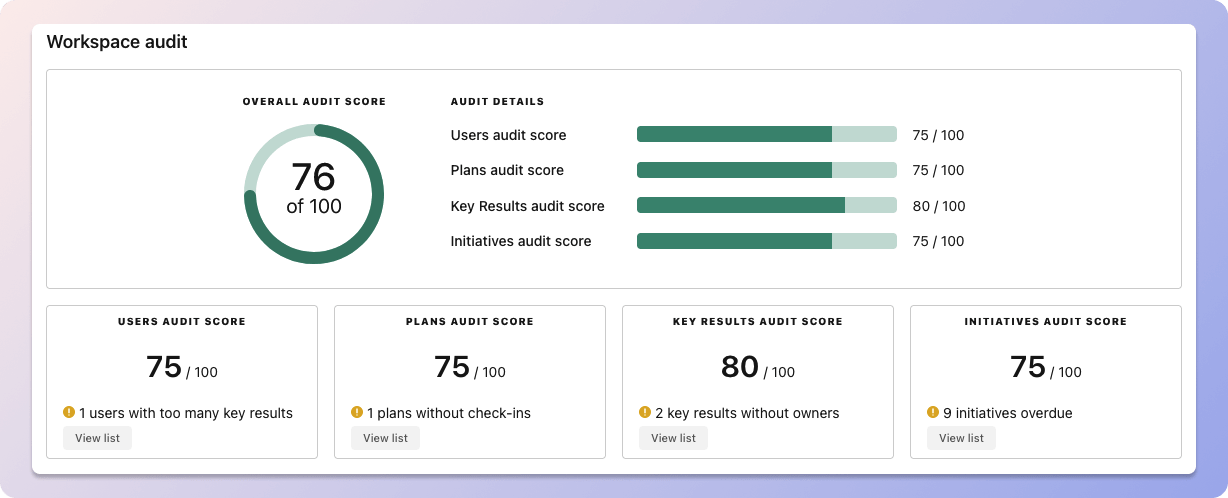

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tability's audit dashboard will highlight opportunities to improve OKRs

Tability's audit dashboard will highlight opportunities to improve OKRsTip #2: Commit to the weekly check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tability's check-ins will save you hours and increase transparency

Tability's check-ins will save you hours and increase transparencyTip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples below). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

Building your own Investment Committee OKRs with AI

While we have some examples below, it's likely that you'll have specific scenarios that aren't covered here. There are 2 options available to you.

- Use our free OKRs generator

- Use Tability, a complete platform to set and track OKRs and initiatives

- including a GPT-4 powered goal generator

Best way to track your Investment Committee OKRs

Your quarterly OKRs should be tracked weekly in order to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

We recommend using a spreadsheet for your first OKRs cycle. You'll need to get familiar with the scoring and tracking first. Then, you can scale your OKRs process by using a proper OKR-tracking tool for it.

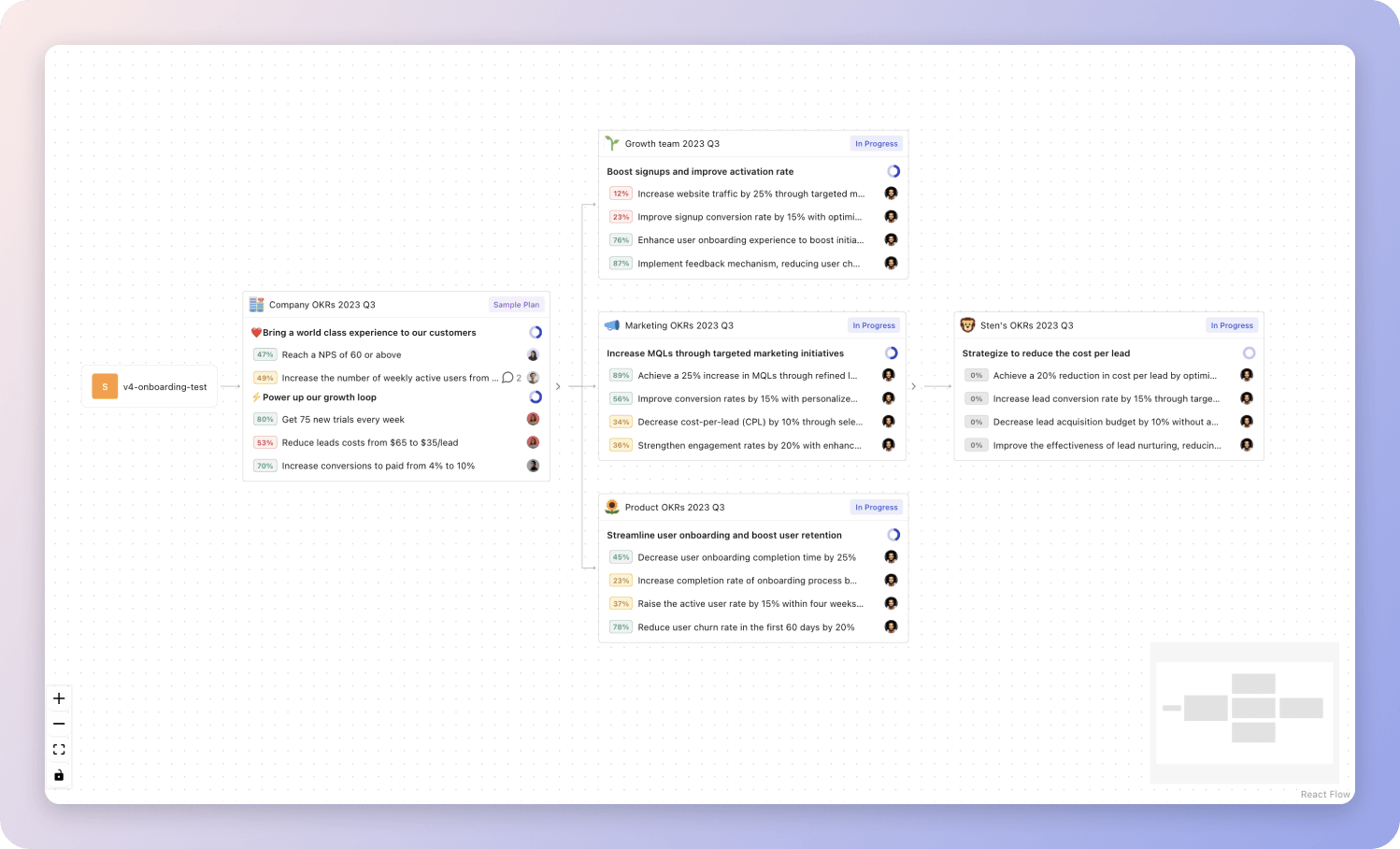

Tability's Strategy Map makes it easy to see all your org's OKRs

Tability's Strategy Map makes it easy to see all your org's OKRsIf you're not yet set on a tool, you can check out the 5 best OKR tracking templates guide to find the best way to monitor progress during the quarter.

Investment Committee OKRs templates

We've covered most of the things that you need to know about setting good OKRs and tracking them effectively. It's now time to give you a series of templates that you can use for inspiration!

You'll find below a list of Objectives and Key Results templates for Investment Committee. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to optimize the performance of our venture capital portfolio

Optimize the performance of our venture capital portfolio

Conduct 30+ thorough due diligence to identify promising start-ups for investment

Present and discuss findings with the investment committee for decision making

Compile a list of potential startups based on industry trends and financial health

Conduct a detailed analysis of each startup's business model and market potential

Increase portfolio ROI by 15% through strategic investments and diversification

Review current portfolio, identify underperforming assets

Conduct market research for profitable investment opportunities

Develop and implement a diversification strategy

Decrease underperforming investments by 20% by performing comprehensive risk assessments

Conduct comprehensive risk assessments on each asset

Identify underperforming investments in your portfolio

Strategically sell off 20% of underperforming assets

More Investment Committee OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to establish a robust internal investor relations framework

OKRs to enhance partnership with business for valuable audit plan fruition

OKRs to enhance fraud detection and prevention in the payment system

OKRs to drive stakeholder UX comprehension and increase customer engagement in decision-making

OKRs to increase player base by 20%

OKRs to enhance capital utilization efficiency of auto-parts trading company

OKRs resources

Here are a list of resources to help you adopt the Objectives and Key Results framework.

- To learn: Complete 2024 OKR cheat sheet

- Blog posts: ODT Blog

- Success metrics: KPIs examples